Crude oil is one of the life-blood commodities critical to the global economy. After refining it can be, and is, used to power cars, trucks, airplanes, and other vehicles. Other fractions are key energy sources for ships, heating, and electricity - some even end up as asphalt.

In addition to energy uses, petroleum and its products are used to manufacture plastics – largely being replaced with natural gas now – and detergents, paint, and various household items. It is not, however, the multiple uses that make crude oil such a favored instrument for investors. Rather, that it is so important and intertwined with the global economy makes the price volatile. Where there are price changes it is possible to profit, after all.

Here we'll cover different ways to invest and trade in crude oil, including using Contracts for Difference (CFDs) . We'll also provide tips and strategies for successful trading.

Fast Execution | Trade on rising and falling market | 24-hour trading | Limit and stop-loss for every trade

Types Of Crude Oil

Crude oil comes in various different types, the two main differentiators being weight or viscosity (so, there are light and heavy crudes) and sulphur content (there are “sweet” or “sour” crude oils). Different regions tend to produce different types – the Orinoco Belt in Venezuela produces a very heavy, sour, oil, the North Sea a light and sweet, just as examples.

Oil then tends to get classified according to its source. This is both because of these types and as a guide to transport issues. The major classifications all have their own “benchmark” prices. So, we can have WCS (Western Canadian Select), Urals, OPEC Reference, Tapis, Bonny Light, Brent, WTI (West Texas Intermediate), Dubai Crude, and Isthmus.

Each different type, heavy or light, will produce different amounts of petroleum or ship bunker fuel – again, just an example among the many different products. Transport will also change. The events in Russia and sanctions have made Urals worth less than non-Russian oils. The US allowing the export of crude oil raised the relative price of WTI. Changes in gasoline demand with respect to ship fuel will change the value of heavy and light oils.

These benchmark and spot prices are therefore in constant movement in relation to each other. A universe of constantly trading prices is just what we desire as traders – it is price changes we desire to trade, after all.

WTI Oil - USOIL price chart today▼

Brent Oil - USOIL price chart today▼

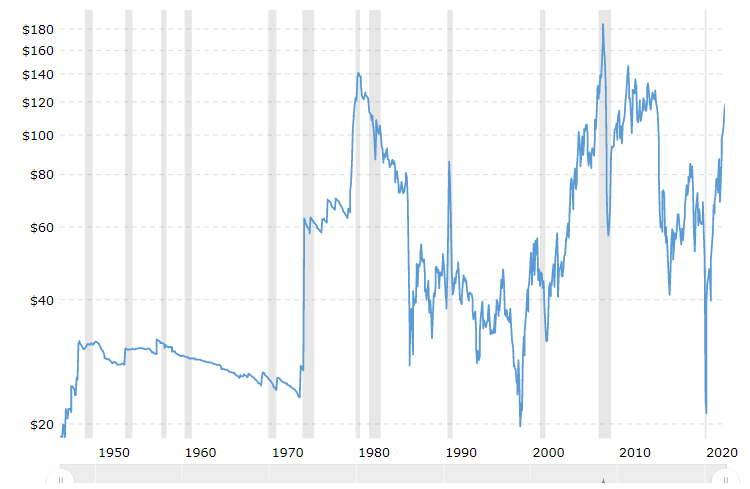

Crude Oil Prices History

The crude oil price remained relatively steady from the dawn of the oil age in the mid-19th century up to the 1970s. Of course, the value of the dollar changed over that time but the nominal crude price didn't very much. Then came the “Oil Price Shock” as oil producers realized their economic power. Since then we've had a highly volatile global crude oil price.

Crude Oil Prices - Historical Chart

What Is The Highest Price Of Oil In History?

The highest crude oil price does depend upon which benchmark we want to align with. The highest international price was $184.94 a barrel in July 2008. Because the US did not allow the export of crude at this time WTI, the main inside the US benchmark was much lower.

What Is The Lowest Modern Day Price Of Oil?

On 20 April 2020, WTI Crude futures dropped below $0. This was more a function of the futures contract delivery date and a lack of available storage than anything else. The following day Brent dropped below $20 a barrel – useful proof of the fact that different benchmarks for crude oil can have very different price movements.

Russia – Saudi Arabia Oil Price War

We did, of course, have a significant reduction in economic activity during the coronavirus lockdowns. As these things work a reduction in economic activity leads to a reduction in demand for oil and thus lower prices across the board for crude oil. It's a global market and one in which supply is relatively inelastic – once you've started pumping from a well you don't stop doing so.

As a result of this, there was a price war going on between Russia and Saudi Arabia (really, all of OPEC, but Saudi is the swing producer here, the one that varies its production the most). Russia didn't want to reduce its production of crude oil, the state budget is based upon the tax collected. Saudi Arabia wished to punish Russia for not so curbing production and so continued to produce at the full rate, driving the price down.

This drove the global oil price down but as above, some benchmarks more than others. The specific April 20th issue was the maturity date of the US futures contract leading to a considerable quantity suddenly becoming available. Yes, the price really did go negative, some producers had to pay to have their oil transported away.

Should You Invest and trade in Crude Oil?

Crude oil is the most actively traded commodity in the world which means there's certainly the liquidity to make trading easy. The price is also volatile – it changes often and a lot – and trading is about being on the right side of price changes. So, yes, there certainly is a possibility of usefully trading in crude oil.

Commodities can be much more risky than stock markets though and oil riskier than many other commodities. So there needs to be a careful consideration of risk appetite before entering the market.

It's only really possible to answer the question of whether to invest or trade in crude oil by considering the trading strategy of the individual investor. That singular calculation of an acceptable risk/reward ratio.

There Are 5 Ways To Invest And Trade In Crude Oil

1. Invest In Oil Based Exchange Traded Funds (ETFs)

An Exchange Trade Fund is a company that sits between us, the investor or trader, and the underlying assets. ETFs exist for nearly every variation we might want to trade and oil-based ones run the whole spectrum. There are oil-based ETFs that hold stocks and shares of oil companies. We buy shares in the ETF and this gives us a portfolio of oil company stocks – rather like a mutual fund.

There are other ETFs that are in crude oil futures, some in options even. These, by design, are not for long-term holdings but for short-term speculations, possibly even only intraday.

2. Buy Oil Company Shares

The share or stock prices of Exxon (NYSE: XOM) or BP (LON: BP.) are clearly going to be influenced by the price of their major output, crude oil. So, it's possible to buy oil company shares as either an investment in or a trade upon the price of crude oil. As with all commodity-producing firms, there is an inherent leverage here, the share price will move more than the oil price.

Note that it is possible to invest – that is, take long-term positions – here and look for the income from the dividends as well as trade for price movements and capital gains.

3. Invest In Master Limited Partnerships (MLPs)

A Master Limited Partnership is more like buying into a specific well or oil field. The difference between an MLP and simply buying corporate shares or stocks is more to do with the tax laws surrounding them than anything else. There is a variation here, where MLPs are commonly listed and available to individual investors, which is in the transportation, storage, and pipeline areas of the industry.

Hess Midstream (NYSE: HESM) for example collects, stores, and exports, but does not drill directly. The economics of this business are not particularly dependent upon the price of crude oil itself so while they are crude-related they often don't move in tandem with the oil price.

4. Trade Crude Oil Futures

As with any large commodity market, there are also futures markets in crude oil. These are the contracts that went negative on April 20th above on their delivery date – there's considerable risk with futures. There are futures contracts on most of the benchmarks, indeed that's what the different benchmarks are for. Brent and WTI particularly exist so as to have a standardized product and delivery point for, respectively, North Sea and Texas oil that futures contracts can be built upon.

When we talk about a “commodities exchange” this is normally what we mean, an exchange that trades commodities futures. A future is a contract drawn up now to agree to buy and sell, respectively, at a predetermined price at some future date. That future will then vary in value over the term of the contract depending upon what the underlying physical price of the same commodity is doing. The important risk factor to know about futures is that you can lose more than your starting position. That is, not only can you lose money you can lose more than you originally started with.

WTI is traded on the New York Mercantile Exchange (NYMEX) and Brent futures on the Intercontinental Exchange (ICE) London.

5. Trade Oil Contracts For Difference (CFDs)

In theory, a CFD can be written on absolutely any price – of a stock or share, a future, an MLP, or an oil benchmark. As a CFD is a derivative product all that is required is a willing market and a liquid underlying instrument. In practice, CFDs are in larger markets simply because that is what more people want there to be CFDs in. A CFD in more detail is simply a derivative trade upon the price of an instrument. As that underlying price changes – the share, future, benchmark – then the CFD creates a profit for one side of the bargain and a corresponding loss for the other side.

In this CFDs resemble futures but with some differences:

A CFD is on a one-to-one basis with the underlying financial instrument

A CFD has noexpiry date – it's possible to allow the position to run as long as desired

CFDs can be very much smaller than futures or options – one single unit is possible in a CFD

The universe of CFDs can encompass any underlying which has a changeable price – even cryptocurrencies

CFDs are not traded through an exchange but over the counter (OTC) with a CFD broker

CFDs are not available to US residents – the SEC doesn't allow them.

Crude oil CFDs will suit traders who wish to speculate on the price of oil without owning any of the underlying assets. CFDs also allow substantial leverage. This allows the risk-tolerant to make short-term trades in a straightforward manner on the future direction of crude oil prices and oil-related instruments.

Fast Execution | Trade on rising and falling market | 24-hour trading | Limit and stop-loss for every trade

CFDs Can Be A Smarter Way To Invest In Oil

● Short And Long Trading

To go short is to be predicting a price fall in the instrument being traded, to go long is to assume a future price rise. CFDs allow speculation on price movements in either direction, which is just a matter of specifying the contract in the right way. This is not always true of other instruments – there can be difficulties in going short on stocks and shares for example.

A trader thinking that prices will decline will go short on oil, one who is predicting a rise will go long. The CFD broker will offer a price and a spread either way which is one of the advantages of the technique.

● Leveraged Trading

It is often possible to gain credit from the broker to maximize the effect of price movements. This is known as “leverage”. The concept is that borrowing to increase the size of the position is like a lever. As with real-world levers, this does increase the strength of the price movement – but it also increases losses as well as profits. Leverage in oil CFDs is entirely possible but needs to be considered properly as part of a risk management system.

● Hedge Trading

Another use of CFDs is to hedge an exposure to the underlying. This is also as with futures – major market participants are those who own actual crude oil and wish to lay off the risk of their doing so. A trader with a position in oil shares, ETFs, even futures, might well back that position with a CFD operating the other way – long as opposed to short, or vice versa – in order to provide risk insurance to the main position.

Risks of Investing Crude Oil CFDs

There's a thought that CFDs are highly complex but this isn't, not really, quite true. What CFDs are is highly risky. The reason for this is that CFDs use leverage – that borrowing to increase the position size and so the exposure to price changes. The higher the leverage then the faster the price changes are multiplied and so the greater the risk.

Experienced traders and investors will find the maximal leverage highly useful and often profitable. The speed with which maximum leverage can change positions makes it important that inexperienced traders monitor their positions and create stop losses,

It's this, the leverage, which makes CFDs instruments that leave no room for misunderstandings or trading errors. The wrong position can be wiped out in its entirety. The use of leverage means that a trader can lose more than the initial capital put up for the trade. Inexperienced traders are advised – strongly – to practice in a demo account before using real – or their own – money.

Despite all of these risks, CFDs are a popular method of trading financial markets, crude oil and derivatives among them. The low barriers to entry and the ability to select the desired instrument make this so. For traders who are on the right side of their positions, there are potential profits. However, all traders need to be cautious and research each trade prior to entering into it, before the execution of it. Leverage both magnifies and multiplies, profits on the upside and also losses on the down.

What Indicators Do Oil Investors Need to Watch?

One of the joys – and difficulties – of predicting the crude oil price is that near everything is important to it. Politics, interest rates, the state of the economy in general, war, inventories, and, of course, what everyone else is doing in the same market. The following indicators are worth looking at when trading oil:

OPEC: Keep an eye on activities and decisions made by the Organization of Petroleum Exporting Countries (OPEC), as they have a significant impact on global oil supplies and prices.

Politics: Political events and developments can have a substantial effect on oil prices, particularly those related to conflicts or changes in government policies.

Interest Rates: Changes in interest rates can influence the value of the US dollar, which, in turn, affects the price of crude oil.

Economy: Oil prices tend to follow trends in economic growth, with stronger economies leading to more demand for crude oil.

Inventories: The amount of crude oil held in inventory can significantly impact the supply and demand balance, affecting prices.

Derivatives: Derivatives markets offer valuable insight into oil market sentiment, as well as providing opportunities for hedging and speculation.

By keeping a close eye on these indicators, you can stay ahead of the curve when trading oil. While they don't guarantee success, monitoring these factors can help you make more informed decisions and improve your chances of profiting from oil investments.

Predictions Of Future Crude Oil Prices

There are predictions of what the oil price is going to be in the future. The International Energy Authority (IEA), the International Monetary Fund (IMF), and the rest of the alphabet soup – OPEC, OECD, and so on – all try their hand at predictions a year and more out. However, this is less helpful than we might think, as they are no more accurate than those made by others.

Additionally, even if we do believe the predictions, according to the efficient markets hypothesis (EMH), they would already be reflected in the price.

In reality, long-term predictions for crude oil prices have an unreliable track record due to the multitude of factors that can influence them.

Why Trade with Mitrade? Fast Execution | Trade on rising and falling markets | 24-hour trading | Limit and stop loss for every trade

Trade Now

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.