How To Make Money with Cryptocurrency( 10 Best Ways for Beginners )

If you are a crypto enthusiast, you probably have a burning interest in starting your trading journey and reaping such profits. You must be wondering, how can I make money with cryptocurrency? What is the best way to invest in cryptocurrency? Today, we'll delve into these questions.

Despite the irreversible trend of cryptocurrency investment, making money in the crypto market is not a cakewalk. In the past, people have made money off the crypto market, some by good luck. Nowadays, winners require deep analysis, great skills, and rich experience to make good profits. If you want to develop your trading skills, start learning how to use candlesticks patterns.

This article explores what hinders beginners from making profits with cryptocurrencies and 10 safe crypto investments.

Please note: The cryptocurrency market's high volatility offers endless trading opportunities. Trade cryptocurrency directly on Mitrade, or continue reading to learn how to make money with crypto.

|

Can A Beginner Make Money Trading In Cryptocurrency?

Trading cryptocurrency can help you make huge profits. However, it also has inherent risks. You can win or lose a large amount of money quickly. This means, while crypto trading is exciting, it can affect your peace of mind, especially when trading under heavy pressure.

You might even start doubting whether you can make money in cryptocurrency. At this point, you will be asking, “should I invest in cryptocurrency?”Here is the good news. By the end of this article, you will know how to make money with crypto.

10 Ways To Make Money with Cryptocurrency

There are many ways to earn money in the cryptocurrency markets, but not all are effective and safe. I will explore some proven methods of investing in cryptocurrency. Here are the top 10.

1 Long-Term Investing

This is probably the easiest way to make money with cryptocurrency. It appeals to people who aren't interested in day trading. Instead, you can buy digital coins, hold in a wallet and wait for the price to rise. The premise of long-term investing is thorough research and believe that a certain cryptocurrencies will gain value after some time.

Although there are many different digital coins, we recommend that you pick safe and highly liquid currencies, such as BTC, and ETH. These are popular coins in the market. New crypto coins might be cheap but are likely to disappear after market trials.

Currently, many people are enjoying tantalizing profits from Bitcoin. These Investors bought Bitcoin before 2012 and held these digital coins for several years. Remember, Bitcoin hit an all-time high of $64000 from just $1 in 2011.

Pros:

■ Easy to start

■ Beginner-friendly

Cons:

■ Take a long time

2Bitcoin Mining

Mining cryptocurrencies is different from trading. While it can be more difficult than other crypto investments, mining tends to be more profitable. You can use a computer to mine cryptocurrency. However, you need basic software, specific hardware, crypto wallets, and lots of electricity. For most people, mining is a highly specialized industry that is not suitable for individual investors.

Most Bitcoin mining is done in large warehouses with cheap electricity. Sometimes, the hardware is also expensive. For example, during the bull market in 2017, the price of GPU rose steeply. However, you can get relatively cheap mining equipment as the market dips.

Initially, bitcoin miners were able to earn coins relatively faster. But nowadays, cryptocurrency mining is more complicated. Many professional miners have built huge mining arrays, making it harder for smaller miners. Of course, you can join a Bitcoin mining pool to be more effective, but that comes with a fee. Crypto mining apps claim to help people mine virtual coins - more like hobby mining. But don’t rely on the apps to make substantial money for you.

Pros:

■ Higher earning potentials

Cons:

■ High cost to start

■ Relatively difficult for beginners

3 Trade cryptocurrency CFDs

Any product with price fluctuations can be traded as a Contract For Difference. CFD is actually a T+0 margin trading tool, which allows you to trade large positions with a small capital. For example, you are able to trade as little as 0.1 lot bitcoin with a small deposit as an initial margin.

The advantage of using CFD is you can go long or go short regardless of the market movement. The fluctuating market provides opportunities to get a return on investment. In addition, trading Bitcoin CFD is flexible, you can trade 24 hours, 7 days a week. It's also popular to use CFDs to hedge physical portfolios for investors, especially in volatile markets.

BTCUSD live price chart from mitrade▼

Mitrade offers you the opportunity to BUY (go long) or Sell (go short) on all Bitcoin trades. Traders will speculate on crypto prices without owning the crypto, so no need to deal with crypto exchanges or open a crypto storage wallet.

Pros:

■ Low deposit with leverage

■ The ability to open long/short positions

■ T+0 trading

Cons:

■ The main risk involves leverage.

■ Not suitable for holding in long-term

4Day Trading

If you are interested in making money faster with cryptocurrency, then you should try crypto day trading. It involves buying and selling orders multiple times in one day. As mentioned, Bitcoin and cryptocurrencies experience high volatility. The roller coaster of price fluctuations is not entirely bad. The ups and downs are ideal for day trading and getting a good profit.

Day trading is a skill just like any other. If you take time to understand how it works, it can be a full-time venture. Of course, all trading positions won't be wins. But the goal of day trading is simply to win more times. So day trading requires investors with extensive knowledge and skills. If you are just getting started, you should practice with a demo account on Mitrade. We will show you how to trade crypto on Mitrade.

Pros:

■ Relatively low cost

■ Earn profit from bitcoin price changes

Cons:

■ Requires high skills

■ It's time and energy-consuming

5 Arbitrage

Some investors opt for arbitrage to make money with cryptocurrencies. Arbitrage involves buying a digital coin in a crypto exchange and selling it on another crypto exchange. But honestly, crypto arbitrage profitable opportunities are rare and probably won't make you rich quickly.

Pros:

■ Instant profit

■ Low entry requirements

Cons:

■ Rare profitable opportunities

■ High risk of losses due to the high volatility in the cryptocurrency markets

6 Cryptocurrency faucet

Crypto faucet is like a dripping faucet, actually a website, releasing small amounts of cryptocurrencies every few minutes. Of course, you need to complete some tasks according to the website requirements. The crypto faucet website makes money from advertising and traffic. It displays advertisements to web visitors.

Pros:

■ Easy to use

■ Easy to earn virtual coins

Cons:

■ Quite a small amount of coins

■ Time-consuming

■ Can't make you rich

7 ICO

ICO means Initial Coin Offerings which are similar to crowdfunding. It enables entrepreneurs to raise funds by creating and selling their virtual currency. It has the potential to make a huge return on investment.

However, ICO has a lot of pitfalls including huge volatility and other inherent risks. You have to be careful about choosing the right ICO. You run the risk of losing money if the ICO coin maintains a low value. Therefore, you'd better invest when you think the project is good enough and only invest what you can afford to lose.

Pros:

■ Opportunity to invest in a virtual coin at an early stage

■ Low entry threshold

Cons:

■ Numerous scams

■ Hacker attacks

■ High risks

8Crypto gaming

Playing games to receive BTC is a fairly common way to earn cryptocurrencies. It is similar to joining the Bitcoin taps above. When new titles are released, they need people to download and play to make the game popular. These games award BTC prizes to woo users. You only need to have a phone and download these games, sit back and play. You will receive BTC after completing the game.

Pros:

■ Easy to earn Bitcoin

Cons:

■ Requires time

■ You receive a small number of crypto coins

■ Crypto scams

9 Be a blockchain developer

Blockchain development is not much different from regular web development. Many developers have created their own decentralized applications (DApp) on platforms such as Ethereum and NEO. You earn money by displaying ads, purchases, subscriptions, etc. on the app.

That said, creating and maintaining a blockchain platform is not easy. First, the code is public and visible to everyone. Put differently, anyone can view the code and check for vulnerabilities. Therefore, any programmer can attack your platform.

Pros:

■ High income

■ Safe way to gain coins

Cons:

■ You must be well-versed in coding

10 Crypto Affiliate

If you own a crypto website or blog, this could be a good source of secondary income. The cryptocurrency industry is growing, but the content can't meet the demand. You can capitalize on this opportunity to create a website specializing in posting news, tips, and instructions for Bitcoin trading.

Pros:

■ Low investment costs

■ Passive income

Cons:

■ You don't control affiliate marketing programs

As mentioned many people ask: how can I make money with cryptocurrency? Now you have the answers. The list above provides 10 incredible cryptocurrency investments.

Experienced traders can benefit from the inherent high volatility of the cryptocurrency market. If you prefer to trade online, using a broker is the ideal decision. It only takes a few minutes to open an account and just TRADE!

Next, we shall explore the process of trading bitcoin (BTCUSD) online on Mitrade. Let's delve right in.

How To Trade Cryptocurrency On Mitrade? 5 Steps

Mitrade offers you the opportunity to BUY (go long) or Sell (go short) regardless of market trends. You can use your preferred strategy, like day trading, swing trading, or news trading, to trade with the price fluctuations.

Mitrade is an online forex and CFD broker based in Melbourne Australia, regulated by ASIC (AFSL 398528), providing more than 400 global markets, including forex, cryptocurrencies, Indices, Australian shares, and US shares.

You get competitive trading conditions, such as 0 commissions, low spreads, and leverage up to 1:200. The minimum volume is 0.01 Lot. You require a deposit of about 230 dollars, according to the current rates, to buy 0.01 lot of bitcoin. This is pretty much affordable to standard traders.

Mitrade also provides you protection against negative balances, enabling you to control the trading risk and have peace of mind.

If you'd like to take advantage of the volatility of cryptocurrencies without remaining physically committed to any specific one of them, trading the cryptocurrency variants ( CFD ) as offered by Mitrade app is the way to go.

◆ Step 1: Sign up to create your account

◆ Step 2: Search and select the markets you want to trade

Mitrade offers more than 400 popular markets including cryptocurrencies, forex, stock indexes (SPX500, Nasdaq100, etc.), commodities (gold, silver, crude oil, etc.), and US stocks (such as Apple, Google, etc.)

◆ Step 3: Open a long or short position

You can use Mitrade's trading tools (such as Strategy / Economic Calendar / News) to explore trading opportunities during market fluctuations.

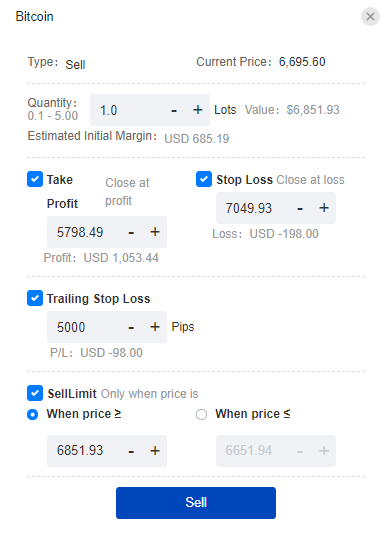

◆ Step 4: Set up your order and Confirm

When you open a position, the order panel is displayed on the screen. It allows you to choose the take profit, stop loss, trailing stop loss, limit order, and contract size easily.

* When you select your position size, your margin will automatically appear on the deal ticket.

◆ Step5: Close the position and withdraw your profit

Close the position once you realize profit and withdraw the money to your personal account.

Trade Popular CryptosAccess a user-friendly platform and app to enjoy easy, low-cost trading. Manage risk using limit and stop orders.

Get Started

What are the trading Fees?

The trading fees are not fixed. Forex brokers charge commissions, spreads, overnight funding, and inactivity fees. You can find out the details on each product specification. Contracts specifications for the main crypto on Mitrade:

Market | BTCUSD | BCHUSD | XRPUSD | ETHUSD |

Floating Spread | 48.00 | 3.00 | 0.0045 | 2.20 |

Leverage | 1:2 | 1:2 | 1:2 | 1:2 |

Contract Size | 1 | 1 | 500 | 1 |

Minimum Volume per Trade | 0.1 | 1 | 1 | 1 |

Overnight Funding - Buy | -0.0487% | -0.0607% | -0.0607% | -0.0607% |

Overnight Funding - Sell | -0.0198% | - | - | - |

Initial Margin | 10.00% | 20.00% | 20.00% | 10.00% |

Maintenance Margin | 5.00% | 10.00% | 10.00% | 5.00% |

***The data might differ due to price changes. Please look at the Mitrade trading page for the current data.

What Hinders Beginners Making Income from Crypto?

Making money with cryptocurrency requires time and consistent effort

Most newbie traders, unlike experienced investors, lack the experience and expertise to fully immerse themselves in the markets. You need enough time to start trading professionally.

Lack of clear trading strategy

Ask yourself: "What is my trading strategy?". If you don't have a strategy it is important that you step back and develop a winning strategy. You might encounter many potential problems based on technical indicators, basic data, or technology. However, a trading strategy will always lead back on track.

You blindly hope to rise

The blind hope of a rebound or Bullrun is common to traders. That's why investment documents repeatedly remind traders that, "What happened in the past is not an indicator of future price movements."

You are averaging your position during the downtrend

Buying when the market is falling can be a good way to buy low. The investors spend money in buy-in hoping to be in an "average" position and cut losses. However, you need to sell as soon as it feels right. Otherwise, the price could decline even deeper before it starts to make any profit.

You completely forgot about risk management

The price of altcoins (or even Bitcoin) experiences extreme fluctuations. You, therefore, need to pay serious attention to risk management. Otherwise, you risk losing your capital. Consider your current average risk level across all assets. Can I recover if one of the coins is removed from the exchange or the exchange is hacked? You could be walking across a minefield if you don't have clear answers to these questions.

You do not learn from past mistakes

Almost everyone has stared at the screen at some point and wished they had more capital. You lose a substantial portion of capital but continue pumping more funds hoping it will rebound. This is a trading mistake you should learn from. If you don't, you might end up losing all your investment capital.

Final Words

Cryptocurrencies provide one of the straightforward and profitable methods to earn passive income. But getting profits is not a walk in the park. You need top-notch trading skills, risk management, and basic understanding of the market.

With that in mind, act now and sign up for an account on Mitrade. Start trading cryptocurrencies and watch your income grow.

Trade Popular CryptosAccess a user-friendly platform and app to enjoy easy, low-cost trading. Manage risk using limit and stop orders.

Get Started

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.