Xom Stock Forecast: Where Does Exxon (NYSE: XOM) Go From Here?

Exxon Mobil, now known as just Exxon (NYSE: XOM) is one of the world's major oil companies alongside Chevron, BP, Shell, and so on. As a major player in one of the world's largest markets – for crude oil and all the derivative products – Exxon is, of course, huge amongst other companies.

More importantly to us, as traders or investors, is where is the Exxon stock price headed? As the market leader in a mature sector, the answer is that XOM's stock price is going to move relative to the oil market itself. It's unlikely that in this short to medium term, there any major changes in technology or market competition. So, as goes the oil market so, to a very large extent, so will Exxon's stock price.

In the very long term, over decades, of course, there is the move to Net Zero and all that about climate change to think of. But that's not something that's going to affect short to medium-term investment horizons nor should we include it in a forecast of XOM's stock price in the short to medium term.

The Exxon Stock Price Immediate Future

In the long term, Exxon has a problem with entirely transforming the business to deal with climate change. That's some decades out and beyond most investment horizons.

In the short to medium term, Exxon's results and so future will be determined by the vagaries of the fossil fuel markets. The more prices rise the better Exxon will do.

In the medium to longer term, Exxon is reliant upon its investment decisions. To develop or not develop this field, or that technology, or to enter other markets. While this matters for the Exxon price in future decades it is not going to be a substantial influence on the price in the next few years.

Current oil prices mean exceptional profits for Exxon. The company is raising the dividend as if those exceptional profits are not there. Instead, they are being diverted to stock repurchases.

We should expect this to continue. The dividend we should expect – expect – to increase with evaluations of long-term profitability. Stock repurchases to correlate with estimations of current excess profitability.

What Does Exxon Actually Do?

Exxon explores for, drills, extracts, and crude oil. It then collects and transports that crude, refines it, and markets the varied products – gasoline, diesel, heating oil, asphalt, and all the rest. This is a very large-scale business and at the scale, Exxon works require tens to hundreds of billions of capital. This is not a line of business which turns on a dime and it is said that the oil companies have the longest-term planning horizons of any organization on Earth. Decisions taken to open an oil field now will still be producing in 50 years time.

Being both a producer and a refiner protects Exxon from some of the vagaries of the market. For example, for decades the US did not allow the export of crude oil but did allow the export of derivatives like gasoline and diesel. This meant that Exxon's domestic to the US crude production could get less than the global price for the oil. On the other hand, the refinery division was able to buy at less than, and export production at the world price. The combination of the two protects to some extent.

Trading Exxon, XOM, Stock Online

As one of the world's largest corporations, it's possible to trade Exxon in a number of different ways. The most common method is to simply purchase the stock; XOM, and hold out while collecting dividends and hope for capital appreciation in the future, this is also a long-term scenario. Exxon is also a component of several US stock market indices, the S&P 500 for example. It's not in the Dow Jones Industrial Average, it was dropped in 2020. It will therefore also be part of any number of ETFs that select from large capitalization US corporations.

Given the size of XOM there are options on that stock and futures in certain OTC – over the counter – markets. It's also possible to trade Exxon through Contracts for Difference, CFDs. This offers exposure, leverage and is also a low-cost way of gaining access to XOM price movements.

Exxon Price History

XOM share price from 2006 to 2023(source: Mitrade)

If we stay within the lifetime of most who read this, then Exxon has been as low as $28 and as high as the current $117. This has shown a great deal of volatility, from a little over $50 to that low of $28 in only two months back in 1997. Another collapse occurred at the start of 2019, from near $70 to $32 or so. And so on. The current surge has taken it from the $32 level in October 2020 to today's $116.

For a company currently valued at near half a trillion dollars, this is extraordinary price volatility. The reason is that Exxon is in the oil business and the crude oil price is itself volatile. Economists explain why the commodity price is so volatile, due to both demand and supply are relatively inelastic.

When both demand and supply are inelastic, it means that the market is less responsive to changes in price, which can result in sudden and significant price movements.

For example, if there is a sudden increase in demand for the commodity due to a supply shock (such as a natural disaster or geopolitical conflict), and the supply of the commodity is limited and difficult to increase quickly, then the price of the commodity may rise rapidly. Conversely, if there is a decrease in demand for a commodity, the price may fall just as quickly

Substantial price changes are required to impact either or both supply and demand in the crude oil market. This phenomenon has a magnifying effect on the price fluctuations of crude oil over the course of economic and political cycles. By staying attuned to these crucial factors, businesses can better anticipate and respond to the shifting dynamics of this market.

The stock prices of commodity producers are, to a very great extent, a leveraged bet on the price of their specific commodity. The cost of production doesn't change with that economic cycle, but the sales price does – profits, therefore, vary wildly with the price of crude oil. Thus the Exxon stock price is volatile over time.

Don't forget, price volatility is the traders' friend. As traders, we're looking for things that change in price so we take advantage of such price movements. Investment for the long term, yes, that's different. Traders look for, live off, volatility.

What Drives Exxon's Stock Price

For any corporation, and the XOM stock price is no exception, the market price depends upon two different sets of factors.

The first is simply how good the company is at doing what is being done. This is internal corporate efficiency we could say. Exxon has, historically, been considered good at this. The oil projects XOM undertakes tend to come into production, at about the forecast capital expenditure, and so on. It's a reasonable assumption that this will continue.

The second set of factors is those outside the corporation's events and matters. For Exxon, the crude oil price obviously matters. That crude oil price is also something not under the control of XOM. Commodity producers are, as a result of the competition they face, price takers in the economic jargon. So, what OPEC does matters to Exxon's stock price. How well Venezuela runs (that internal efficiency that is) PDVSA, the national oil company there. Things like invasions and sanctions – as with Russia. That has had a large effect just recently as Exxon has had to leave project in that country. Then there are the general macroeconomic cycles – recessions usually reduce the price of oil, expansions increase it.

So, the drivers of XOM's stock price are those two sets of factors – what's happening out there in the global economy plus the internal efficiency with which Exxon runs the company itself.

Exxon Stock Price Volatility And Accounting Rules

There's a little twist to this story about XOM here, buried in the accounting rules. While we've already noted that Exxon's stock price is volatile, it is also less volatile than some of the other industry counterparts – such as Shell or BP. This is because of a difference in accounting rules for US and non-US companies.

Oil does not magically leap from the wellhead to being cash in the corporate accounts. It must be collected, transported, refined, shipped and only then actually sold. So, at any one time, an oil company has some amount – usually some months – of production in that pipeline. When the oil price changes all of that working stock also change in value. How the change in inventory value is being recorded matters, and there are differences between the US and non-US practices.

US companies, like Exxon, can use GAAP rules and these allow for the “last in, first out”(LIFO) process; the last barrel of oil to go into the system is accounted for as the first barrel sold. The effect of this is that when oil prices change upwards then the oil being sold right now is given a cost of the oil price right now. Those months of supply in the system and their historic cost are, largely, ignored. This has the effect of reducing profits at Exxon when the oil price rises.

Non-US oil companies cannot use this technique under IFRS accounting standards – they tend to use the, “first in, first out” method (FIFO). This has the effect of maximising recorded profits as crude oil prices rise and also maximising losses as they fall. All those months of oil in that production pipeline are recorded at their historic cost and sold at the new market price.

This means that recorded profits at Shell, BP, and so on are more volatile than those at American companies like Exxon. To the extent that investors price Exxon stock by recorded profits, this lowers XOM stock price volatility compared to other oil majors.

Exxon Stock Dividend Payments

There is a well-known preference for companies to achieve constant and consistent rises in dividend payments. Any forecast for XOM dividend payments, therefore, has to take this into account. The argument is that management like to show increasing internal efficiency, as above. One of the ways to do that is to manage dividend payments so that they continually increase over time.

The implication of that is that bursts of excess profits do not get paid out as dividend increases. For this would make continuing to increase the dividend in the next accounting period more difficult.

It is also true, as we've already noted, that Exxon's profits are wildly variable due to circumstances outside their control – that global price of crude oil. So, what happens is that yes, there are bursts of excess or windfall profits over the years. But these are not reflected in a permanent rise in the XOM dividend.

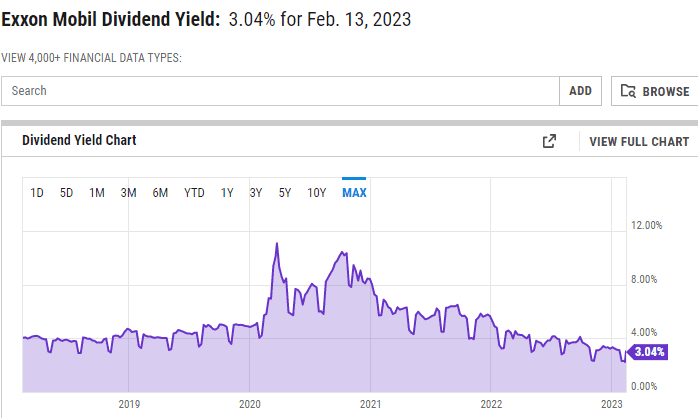

Exxon share dividends(source:Ycharts)

We can use the most recent results as an example here. This past year, 2022, was obviously a good one for oil companies. Exxon made $56 billion in profits over the year. But the dividend for the current quarter is $0.91 cents per share, largely unchanged (up 3 cents, which is a small change). That dividend will be paid on March 10, for shareholders of record on Feb 14, the XOM stock going ex-dividend on Feb 13. So, where will all those extra profits go if not to shareholders via a dividend increase?

Exxon has also announced an addition to the stock buyback program with up to $35 billion of such stock repurchases in 2023-2024 (on top of previously announced plans, taking the total to $50 billion).

Normal and ongoing – supportable, that is – profits tend to get paid out via the dividend. Exceptional and windfall profits tend to get paid out as stock repurchases. Last year's profits were up 144%. But the dividend wasn't – that excess goes to the stock purchases.

Exxon Stock Price Predictions

XOM stock price predictions are pretty conservative at the moment. Some analysts offering predictions of the Exxon stock price out to 12 months in the future and the range is $140 to $101. With the current price of $115 or so, the median is $123. That's not being terribly adventurous it should be said. But then the most likely economic forecast for any number is around and about the same as today plus or minus a bit.

The real thing to take from those forecasts is that no one is really predicting a major change in the global economy and thus crude oil prices. That may or may not turn out to be correct of course. Already we're seeing a difference between what analysts are assuming the oil price will be ($90 for most) and what the futures markets predict oil will be ($70).

The problem with such price predictions is that, to the extent that investors believe them, they are already at the current price. The current market price already includes the estimates that it will be between $101 and $140 in a year's time. It is things that are not already included in the analysts' assumptions that will break it out of that range.

WhetherThe XOM Stock Price In 2023 to 2025?

A reasonable deduction is that Exxon is not going to become markedly less or more efficient in the next couple of years. They've been operating for more than a century now and there's been a gradual advancement in their internal efficiency across that time. So the Exxon as specifically Exxon part of our valuation calculation doesn't really change over the short to medium-term future.

What can and quite possibly will change is the price of crude oil. As we've already discussed, commodity producers are price takers – they just do have to sell at the global price for their output. That's essentially what the definition of a commodity means. So, significant changes in the Exxon stock price are likely to be driven by those wider global events which drive the crude oil price. Global economic growth – or slowdown – and the activities of OPEC, sanctions, and so on. All matters which are not under the control of Exxon's management.

There could be changes in Exxon's stock price relative to other oil majors as a result of actions by the management of Exxon. But the XOM stock price in real, not relative, terms really depends upon the crude oil price.

Start your first trade

Register a demo account for free and level up your trading skills. At the same time, enjoy a sum of $50,000 virtual money to practice and formulate your best strategies before switching to a live account.

Forex 丨 Index 丨 Shares 丨Commidities丨MoreStrictly regulated0 commission, low spreadsDaily Forex Signals with analysisNegative Balance Protection

Forex 丨 Index 丨 Shares 丨Commidities丨MoreStrictly regulated0 commission, low spreadsDaily Forex Signals with analysisNegative Balance Protection

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.