Forex Brokers Types: ECN VS Market Makers VS No Dealing Desk

A good broker is one of the pillars of a successful trading career. This is why traders must carefully scrutinize the various types of brokers available in the industry to pick the best possible option.

What Is A Broker In Forex?

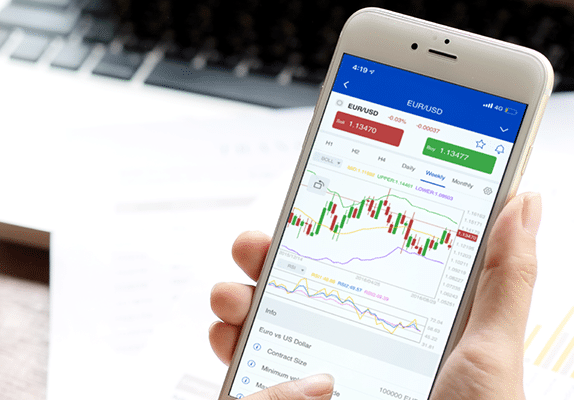

A forex broker is a financial brokerage firm that acts as an intermediary between you and the market, providing a platform for traders to buy and sell currency pairs. Forex brokers will charge a commission or spread on each trade in return for executing a buy or sell order.

Achieving success in the forex market is challenging. It becomes even more difficult to choose when a forex broker is hell-bent on ensuring that none of their customers enjoy consistent profits.

? Get FREE Access to our strategies using the mitrade Demo Account.

Many traders run with the consensus that brokers with acronyms like ECN, NDD, and STP are the best.

Are they?

Well, the meaning of these acronyms has nothing to do with the capacity or attributes of the brokers.

This article will clear up the confusion, burst a few myths, and help you make a more informed decision when choosing a forex broker.

The Different Types of Brokers

There are 3 main types of brokers: ECN brokers, Market Maker, and No Dealing Desk (NDD).

ECN Brokers

ECN is an acronym for Electronic Communication Network. ECN brokers technically take orders from clients and send them directly to a pool of liquidity providers.

The quoted prices displayed by ECN brokers are some of the best you will find as they come from multiple institutions and market participants

| Pros | Cons |

No price manipulation by the broker | Requires large initial deposits |

Lower spreads | Commissions charged |

Faster trade execution | Spreads are variable and can be higher at intervals |

All trading strategies allowed | |

No requotes even during high volatility |

Verdict

Generally known as A-book brokers, ECN brokers seem like the holy grail in forex trading. Unfortunately, this misconception highlights a prevailing lack of understanding of how the market works.

Many traders believe that ECN brokers are the best because orders are matched up with the opposite requests at all times. This is not the reality.

The forex market is different from the stock market. There is no central exchange, so it is impossible to have all EURUSD buy trades, for example, matched by EURUSD sell trades.

This is a false and widely-held misunderstanding about ECN brokers by the forex trading community. Imagine a scenario where 80% of the traders have long positions on the EURUSD? How will the trades be matched up?

ECN brokers in forex only send your order directly to a liquidity pool. This pool will contain banks, institutions, and other brokers. The brokers do this to get better prices and more favorable spreads. ECN brokers also do not bear any risks on all client positions. So, when you make money, the liquidity providers pay the profits.

ECN brokers typically make money from commissions. However, some of them also make money from spreads by offering slightly higher values than what they receive from the liquidity providers.

Forex brokers understand that traders trust brokers with the acronym ECN affixed to their brand name. Therefore, they do whatever it takes to be addressed as a “True ECN” broker, including getting regulation in shady countries.

The brokers regulated in stricter jurisdictions try to navigate the red-tape by using terms like Straight Through Processing (STP) or Direct Market Access (DMA) to suggest that they are ECN brokers.

It is all clever marketing. If you decide to go with an ECN broker, remember that your trades are only sent to a larger pool (for the real honest brokers). They are not matched to the orders of other traders.

Fear of trades manipulations by brokers is not enough reason to choose an ECN broker. Many non-ECN brokers are honest and engage in any manipulations.

Market Makers

Also known as B-book brokers, a market maker does not send your orders to a larger liquidity provider. They internalize the risk for all opened positions, meaning they pay for all positive trades from their pockets.

| Pros | Cons |

Low initial deposits | Price manipulation is possible |

No commissions | Fixed spreads might still be too costly |

Flexible leverage | Scalpers may not be welcome |

Verdict

Because of years of misinformation, market makers have a poor reputation in the forex world. Unscrupulous market makers exist, but not all brokers are bad. Many of the most respected forex brokers today, including Mitrade, are a part of this group.

Yes, they make money when you lose, but the most reputable ones never go out of their way to make you lose. They provide the best prices, ensure fast execution, honor all your market or pending orders, and pay your profits when you initiate a withdrawal.

More than 75% of traders lose money every year. This means that reputable market makers can make more profits than other forex brokers without lifting a finger. Is there any need to cheat, really?

When you choose ECN brokers (or similar), your order goes to the liquidity pool created by banks and other institutions. These institutions “make” the market. So, in reality, you are still trading with market makers, just on a larger scale.

So, there is nothing wrong with choosing a market maker broker if they meet all other requirements. A huge advantage of choosing these brokers is there is no fear of false marketing. You know what you are getting.

No Dealing Desk

No Dealing Desk (NDD) in forex means that the broker operates an Electronic Communication Network (ECN), Straight Through Processing (STP), or Direct Market Access (DMA) model. Such brokers route your orders through larger liquidity providers.

| Pros | Cons |

Price comes from liquidity providers | Trading costs can be prohibitive for retail traders |

Trades are executed fast | Low leverage options |

No requotes | |

Low spreads |

Verdict

No Dealing Desk (NDD) brokers are the same as most ECN brokers. The acronym NDD is sometimes used by brokers that do not want to fall short of regulatory requirements by claiming ECN status. The bottom line is that such brokers will send all your orders to a pool of liquidity providers instead of internalizing them.

Keep in mind that many NDD brokers still run a market-maker model where they keep smaller orders in-house but send larger orders directly to the liquidity providers. There is nothing wrong with this business model as it allows the broker to make more money while taking only half the risk.

Which Brokerage Model Should You Choose?

Now that you know all the types of brokers available, you should be able to make the right decisions.

The following factors should guide you:

● Regulation

A reputable market maker broker trusted worldwide and regulated by the ASIC like Mitrade is a better option than a self-styled ECN broker operating from a small island country. It is also essential to confirm that a broker is legally allowed to serve customers in your location.

● Deposit protection

What happens to your capital if the broker goes bankrupt? Only choose brokers that keep trader deposits in segregated accounts and also have an insurance policy in the event of bankruptcy.

● Spreads/Swaps/Commissions

The best brokers offer competitive spreads and swaps. Ensure you are comfortable with the spreads and swaps charged by any broker, regardless of their classification. For brokers that charge commissions, confirm that their pricing is favorable for you.

● Trading instruments offered

Mitrade offers more than 100 tradable instruments, including currencies, indices, commodities, and cryptocurrency. Not many brokers can match this. So, before you fill out an account, ensure that the broker has all your best pairs.

● Compatibility with your trading strategy

Some brokers try to discourage certain types of trading, including scalping and hedging. Is your trading strategy allowed on your chosen broker?

● Minimum and maximum deposit requirements

If you can only afford a $500 account, don’t choose a broker with a $1,000 minimum deposit. In the same vein, a broker that cannot accept your $500,000 account may be too small for you.

● Deposit and withdrawal options

Flexible deposit and withdrawal options make it easy to manage your account. The best brokers have more than three funding options.

● Customer service

Some forex brokers have a high entry barrier for customers and will not spend as much time pleasing the average retail trader. On the other hand, others will allocate resources for acquiring and retaining all kinds of customers, making them more retail-friendly.

Read more:

>>9 Of Leading Low Spread Forex Brokers

>>How To Use Stop Loss In Forex Trading?

NOTE:

When choosing a broker, do not make the mistake of judging them based on the results generated on demo account. A demo account is only perfect for getting to grips with a trading platform. The real execution time spreads and commissions can only be verified on a live trading account.

When you find a broker that ticks all the right boxes, test them with a fraction of your capital. If you are fully satisfied, you can make more substantial deposits.

Conclusion

Brokers are more than their designated acronyms. Do not be deceived by smart marketing when analyzing the different types of brokers. Focus on the factors that matter to ensure the safety of your trading capital and any profits you have made.

The best brokers will provide an environment that allows you to focus on your trading.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.

- Original

- Trading Analysis

![10 Of Leading Low Spread Forex Brokers 2023 [Tight Spread Brokers]](https://resource.mistorebox.com/insights/cms_uploads/images/article/2020-04-14/invest.png)

Risk Warning: Trading may result in the loss of your entire capital. Trading OTC derivatives may not be suitable for everyone. Please consider our legal disclosure documents before using our services and ensure that you understand the risks involved. You do not own or have any interest in the underlying assets.