A Step-by-Step Guide for Using Head and Shoulders Pattern to Identify Suitable Trade Entry Points

Does the head and shoulders pattern ring a bell? You have likely come across the pattern in your trading journey. Whether you are a seasoned trader or a beginner, it is one of the patterns you need to be conversant with.

The head and shoulders chart pattern boasts high accuracy and reliability. A study by the Samurai Trading Academy puts the success and reliability of the head and shoulder pattern and its inverted version at 83%. It is one of the patterns with the highest winning rate.

This guide will explore how the pattern forms and how to use it to trade profitably. You will use the pattern like a pro by the end of this article. So, read on.

You can use Mitrade forex app to practice your trading skills!

Learn More Open Account Windows/ App IOS/ Android

Major Attributes: How to Identify the Head and Shoulders Pattern

Before you start trading with the head and shoulder pattern, you must identify the most suitable formations in the market. The market moves haphazardly, and you should be able to isolate the pattern as it forms and wait patiently for the opportune point to enter the market.

The pattern has five major attributes: an uptrend (downtrend), left shoulder, head, right shoulder, and neckline.

Uptrend

During an uptrend, the market rises with high momentum before exhaustion. More extended uptrends lead to substantial reversals. In the case of an inverted head and shoulders pattern, a downtrend precedes other elements.

After a solid rising trend, the trend reaches exhaustion, and bulls start exiting the market. This leads to the formation of the next element, the left shoulder.

Left Shoulder

As mentioned, the uptrend dwindles, and a pullback follows. The market action drops to form a higher low. The pattern takes shape, but it is not enough to identify the formation or draw the neckline.

The Head

After hitting a higher low, you should be on the lookout. Wait for the market to create a head. The market resumes the uptrend to reach a higher high creating a head before retracing. But the pullback loses steam and finds support at the same level with the left shoulder.

At this point, we have a left shoulder and head. However, the attributes are not enough to draw the neckline. This is where the right shoulder comes in handy.

Right Shoulder

The right should complete the pattern, and everything falls into place. It signifies that sellers have overcome buyers, and the trend is ready for a reversal. So how do you identify an ideal right shoulder?

After the hitting support level, the market rallies, but the buying pressure is not enough to surpass the head. Instead, it forms a lower high, typically equal to the left shoulder.

Neckline

With a right shoulder, head, and left shoulder in place, you can easily draw a neckline by connecting the support level. The line connecting the low of both shoulders and the head becomes the neckline.

Inverted Head and Shoulder

The head and shoulder pattern can form anywhere on the price action. An ideal head and shoulder should come after an extended uptrend.

In some cases, the head and shoulder appear after the end of a downtrend facing upwards. In this case, the pattern is an inverse head and shoulder pattern. However, it uses the same psychology. However, the bears eventually overcome the bulls pushing the price upwards.

But What Makes the Trend Reverse?

This is where it gets so interesting. Each formation has an inherent message with the ease of decoding the message, varying with each pattern. So, what does the head and shoulders pattern tell you? The general explanation is that the bullish pressure is dwindling, and the market is poised for a reversal.

To give you a clear perspective, it is imperative that we examine the psychology behind pattern formation.

The Psychology Behind the Pattern Formation

The first thing traders, especially newbies, should understand is that the head and shoulders structure does not cause the reversal. Instead, the interaction between buyers and sellers creates the structure and causes the market reversal.

The head and shoulder is a red flag for bulls long on the underlying instruments. They should get ready to close their positions.

But the signal ripens technically after the price breaks below the pattern's neckline. The pattern is tradable after the market closes below the support. At this point, you should consider closing long positions and adding to short orders but with strict adherence to risk management.

A common mistake happens when the traders assume the pattern is complete after forming the last shoulder and jumping into the market.

That said, here is the psychology behind the pattern formation.

The left shoulder forms when bulls book profits after an uptrend and close their positions. However, the market pulls back and hits support providing traders with a good buying opportunity.

The buying pressure pushes the price up and hits a new high- head of the pattern. After an uptrend, happy traders close positions with profits. Although the market reaches new highs, the volume is relatively low signifying a dwindling buying pressure.

As the trend weakens, sellers enter short positions pushing the price down. Again, the instrument enters an oversold area giving buyers a good entry point. But the low buying interest is not enough to form a new high.

The price declines, creating the right shoulder completing the pattern. After confirmation, the price comes tumbling down.

The Volume Factor

The volume is essential in understanding how to use the head and shoulder pattern. In fact, it is essential to most patterns.

Essentially, trading volume informs the formation of the three peaks.

We have pointed out that a tradeable head and shoulder pattern must close below the neckline. The right shoulder is formed with substantial volume, which significantly decreases during the formation of the head, signaling a dwindling pressure. The buyers are not as aggressive as they were.

The bulls are exhausted, and the volume is even lower during the formation of the left shoulder.

The bears push the price low, and a reversal is confirmed when the trend breaks below the neckline.

The volume increases significantly as the market establishes a new trend.

How to Enter the Trade Using the Head and Shoulder Pattern

Here is where it gets really fun; trading and making a profit in your real account using the head and shoulder pattern.

Learn More Open Account Windows/ App IOS/ Android

Are you ready?

There are various ways to enter the market using patterns. In this guide, we will narrow our discussion to two methods.

Technique 1: Using a Limit Order

This method involves setting the sell limit order below the neckline. You enter the trade as soon as the market crosses the trendline. This means that you don’t necessarily have to wait for the price to close below the neckline.

However, this method makes you susceptible to false breakout. This happens when the market hits the limit order and opens a position. But the market resumes the initial trend instead of reversing.

For these reasons, the second method is more plausible and will be our primary focus.

Technique 2: Wait for the Market to Close Below the Neckline

This method is much better and more informed. Remember, patience is a virtue in trading. In fact, the money flows from greedy and impatient traders to those willing to wait for the opportune time.

What makes this method even more suitable is the fact that it involves waiting for a retest. This helps establish the validity of the breakout and gives you a higher risk to reward ratio. You, however, risk missing a trade entry as you wait for a retest.

Determining an Ideal Take Profit

Most people think that finding a good setup and signal is the most challenging aspect of trading. But this is a part of the trading process. Setting your profit target is equally challenging and can mean the difference between making profits and losses.

Use Mitrade forex app to practice your trading skills!

Learn More Open Account Windows/ App IOS/ Android

With the head and shoulder pattern, there are two ways of placing a market target.

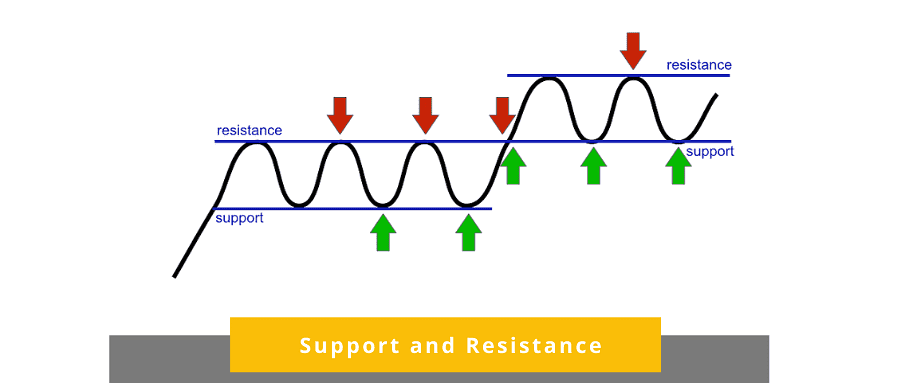

Method 1: Using a Key Area of Interest

This is quite a conservative approach that involves taking profit at the next support level. These areas of interest are market levels where the market is highly likely to reverse. Conventionally, you will want to close your short position at the next support level.

Be cautious of minor support levels. Ideally, use the support level that gives you an ideal risk-reward ratio. You should therefore do your calculations well before placing the take profit.

Method 2: Measured Objective

Alternatively, you can use the more aggressive and universal approach of measured objectives. Essentially, this method involves measuring the pattern height and replicating it as the profit target.

To be specific, measure the distance from the neckline to the top of the head. Now, take the same measurement and draw the same distance from the breakout point.

Remember some neckline slant at an angle. Therefore tracking the measurement is a highly important detail, albeit seemingly minor. The measured objective can prove pretty accurate.

Remember to include other risk management techniques to protect your profits, considering the target area can be quite far from the entry point.

For instance, choose an area where the measured objective coincides with a key support area to establish confluence. In addition, it will help you enter the trade more confidently.

Stop Loss and Risk Management

You can't trade with utmost certainty despite how certain a trading signal is. You need proper risk management to protect your account if things turn sour.

Traders have different ways of placing the stop loss depending on their risk appetite.

Here are various ways to exit the market if the trend doesn’t honor the head and shoulder pattern.

Method 1: Place stop above the right shoulder

Placing the stop loss above the right shoulder gives the market enough room to play at a safe distance from your stop loss.

But on the flip side, the stop loss might be relatively too far and significantly increases the loss if the trade goes wrong. In any case, the signal fails when the market fails to close below the neckline and moves downwards.

If the market actually closes above the neckline, the signal is deemed to have failed. In this case, it is not necessary to wait for the market to take out the stop loss. Otherwise, you risk making big losses because the stop could be a hundred pips away.

A loss can significantly eat away and reduce your risk-reward ratio.

Method 2: Put the stop loss above the recent swing high

This is perhaps the most suitable and preferable risk management method of placing the stop loss. One of the benefits is that it gives you a good risk-reward ratio by reducing the risk when the signal fails.

You also have the leeway to reduce the risk significantly by using a tighter stop loss.

Notice that, the tighter the stop loss, the more likely you will be stopped out prematurely.

Method 3: Exit when the market closes, Above the Neckline

The whole idea is to trade using the pattern. Therefore, if the pattern does not close below the pattern, it invalidates the signal. You, therefore, exit when the signal fails.

This helps to reduce the risk significantly. In fact, you can use this risk management method to deal with other trading tools and patterns.

Real Trading Examples

A chart of the Euro against the Australian Dollar on a daily time frame

Notice how an uptrend precedes the chart pattern. The price pulled back after forming the peak of the left shoulder. However, the bulls come into the market with a renewed energy boosting the buying pressure which pushes the price up, hitting a new higher high. Again the price tumbles but finds support at the neckline.

The bulls try to push the price high, but the bears overpower them pushing the price lower.

Notice how the neckline is slanting upwards. This boosts the magnitude of the selling pressure. In fact, the reversal is so massive and profit substantial. If you had opened a short position you would have raked in 600 pips ( 1.5951 to 1.5356). Some tantalizing profits if you ask me!

Next time you notice a similar pattern, do not hesitate and you will be laughing to the bank.

How To Choose Suitable Head and shoulder pattern

At this point, you are conversant with the structure and composition of the head and shoulders pattern. But not all patterns will be profitable. Some are more ideal than others, and you should eschew low probability setups.

Now how do you choose the high probability head and shoulder patterns?

Here are the top considerations.

1. Preceded by Strong Uptrend

An ideal pattern forms after a massive rally. The rule of the thumb when trading a bearish reversal pattern is the presence of a large white space to the left. This means you will want to avoid setups near recent swing highs.

2. Horizontal or Ascending Neckline

Slanting neckline

Slanting neckline

Typically, the neckline should be horizontal, meaning the head and shoulders find support in the same level. A neckline that slants upwards is also acceptable. In fact, these setups lead to aggressive breakouts and reversals.

You will want to avoid a pattern with a neckline that slants downwards. It is possible a reversal could follow, but the odds are against you. This means you don't have an edge.

3. The head should Tower above both shoulders

The head and shoulders pattern should be evident from a quick glance. If one or both side peaks are equal to or above the center peak, that is not a head and shoulder formation. In any case, the shoulder can never be above the head, right? We thought so.

If you have doubts about the pattern's validity, it is best to stay out.

4. Use Higher Time Frames

The lower time frames, such as 5 mins and 15 minutes time frames, are susceptible to market noise. For highly reliable and valid setups, you should stick to daily, weekly, and monthly setups.

The 4-hour and 1-hour can form a resemblance of the pattern but at the risk of catching little profits. Consistent patterns form the above daily charts and are not prone to false positives.

Final Note

The head and shoulder pattern signals that the market is poised for a reversal. You should get ready to open a short position when it forms after an uptrend. When it appears after a downtrend, it indicates that bulls are taking control of the market, and you should get prepared to go long. In this case, the pattern is referred to as the inverted head and shoulder pattern.

Consider using other technical tools to establish confluence and give you more trading confidence. Use Mitrade forex app to practice your trading skills!

Learn More Open Account Windows/ App IOS/ Android

FAQ

● What is the head and shoulder pattern in trading?

The head and shoulders pattern is a popular chart pattern that is easy to spot and characterized by a baseline with three peaks. The center peak is the highest and is referred to as the head while the two side peaks are known as shoulders. The baseline or support is called a neckline.

● Is the head and shoulder pattern bullish or bearish?

The head and shoulder pattern is a bearish signal indicating the uptrend is coming to an end. It is one of the most accurate and reliable trading patterns.

● How accurate is the head and shoulder pattern?

It consists of two swing highs and a new higher high between the shoulders. The head and shoulders are a highly accurate reversal chart pattern with an estimated accuracy rate of 85%.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.

- Original

- Trading Analysis

Risk Warning: Trading may result in the loss of your entire capital. Trading OTC derivatives may not be suitable for everyone. Please consider our legal disclosure documents before using our services and ensure that you understand the risks involved. You do not own or have any interest in the underlying assets.

.jpg)